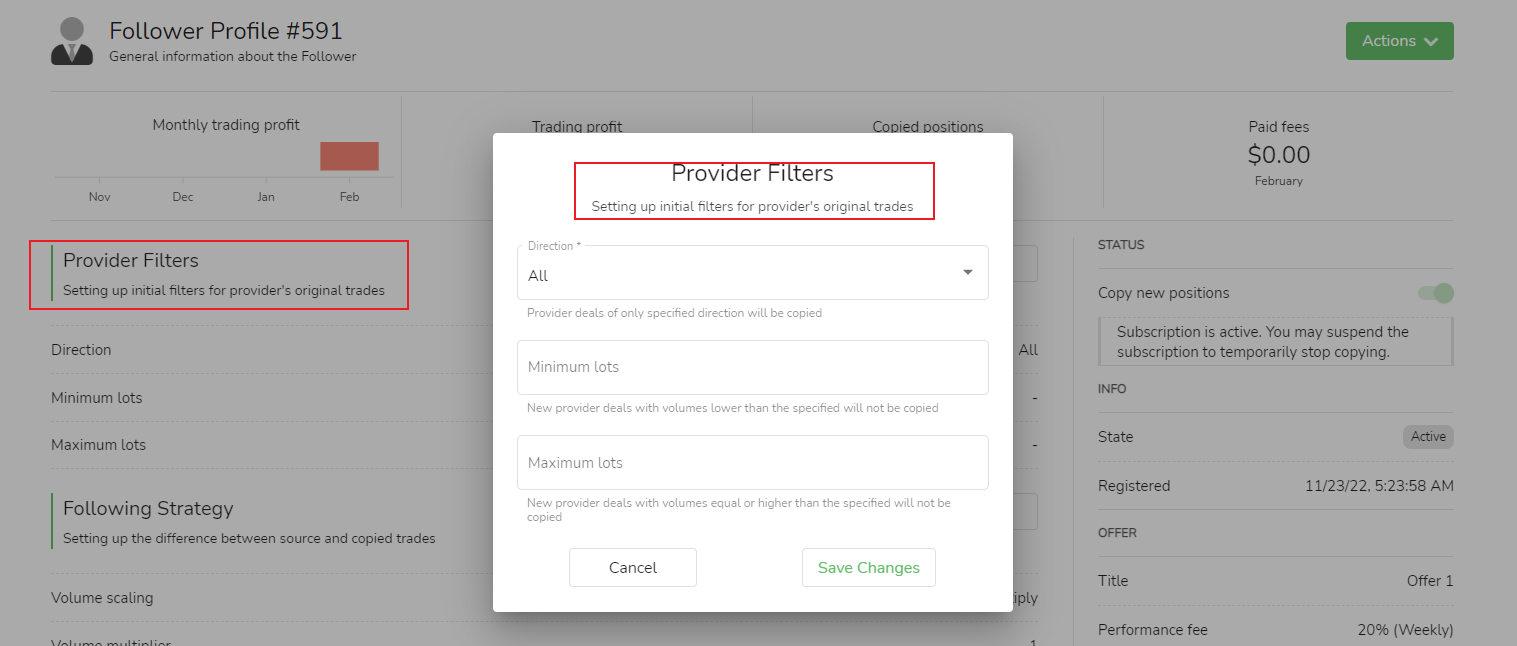

a. Filter conditions

Followers can set filter conditions for following transactions.

direction:It will only follow the transactions in the specified direction, and you can choose [All], [Buy] or [Sell].

-

- Buy: The follower will only follow the trade in the buy direction of the signal source.

- Sell: The follower will only follow trades in the sell direction of the signal source.

all:The follower will follow trades in all directions of the signal source.

Minimum lot size:The follower can choose the minimum lot size to follow the volume. When the trading volume of the signal source is lower than the set trading volume, it will not follow.

Maximum lot size:The follower can choose the maximum lot size to follow the volume. When the trading volume of the signal source is equal to or greater than the set trading volume, it will not follow.

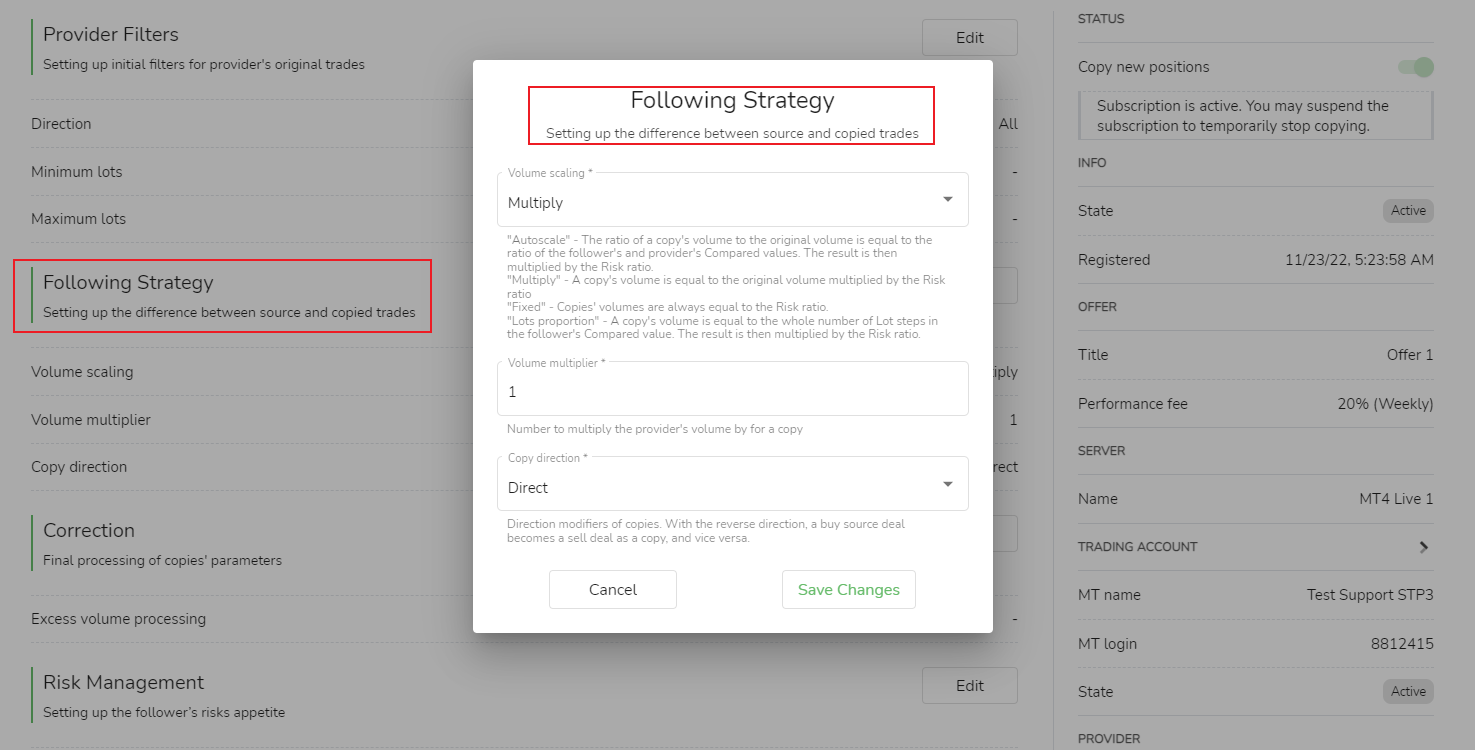

b. Follower copy mode setting

Followers can choose a copying method that is different from the signal source.

b.1 Volume Expansion

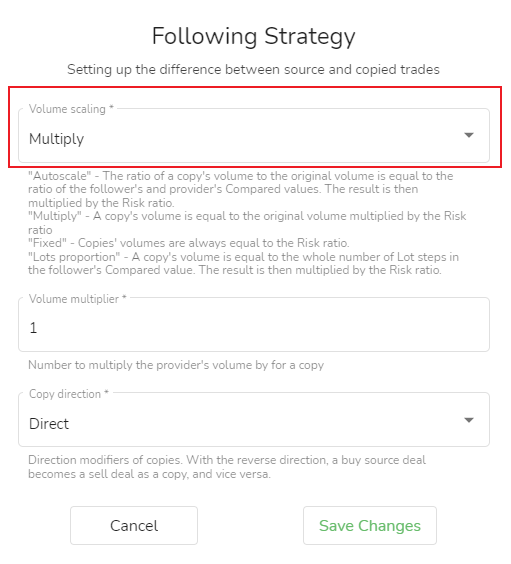

b1.1 multiplied by

-

- The due position of the copy account is equal to the signal source account's transaction volume multiplied by the transaction volume multiplier

Calculation formula:

Follower trading lot = signal source trading lot * trading volume multiplier

-

- Volume Multiplier

The number multiplied by the volume of the signal source in a following trade

-

- copy direction

Direction modifier for copying trades.

-

- Positive: The signal source is short, and the follower is short. The signal source is long, and the follower is long.

- Reverse: signal source long, follower short, signal source short, follower long.

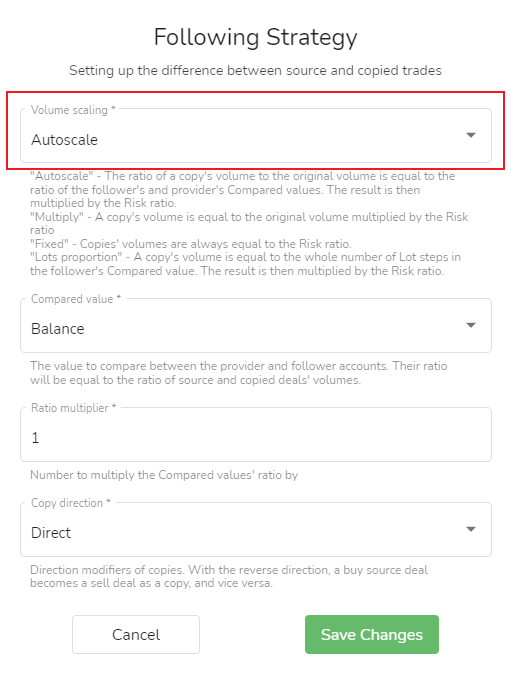

b1.2 Automatic scaling

The ratio of the balance (or equity) of the follower account to the balance (or equity) of the signal source account is equal to the ratio of the expected position of the follower account to the actual position of the signal source account, multiplied by the ratio multiplier set by the follower account. By comparing the ratio between the balance (or equity) of the following account and the balance (or equity) of the signal source account, the follower can use this as a ratio to realize automatic scaling and adjustment of its own trading position.

Calculation formula:

Follower's trading volume = signal source's trading volume * (follower's trading volume / signal source's trading volume) * ratio multiplier

Comparison value:The ratio between the trading volume of the signal source and the trading volume of the follower's account. You can choose [Balance] or [Equity]

Ratio Multiplier:A number to multiply with the comparison value.

Copy Direction:Direction modifier for copying trades.

-

- Positive: The signal source is short, and the follower is short. Signal Source Long, Follower Long

- Reverse: signal source long, follower short, signal source short, follower long

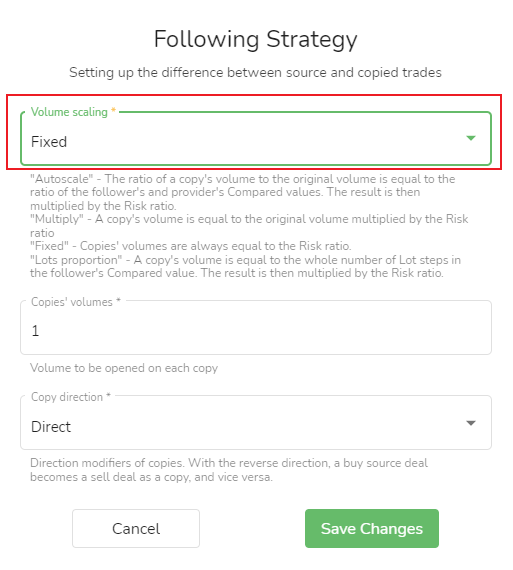

b1.3. Fixed

The trading position of the documentary account is always consistent with the set volume of the documentary transaction

Calculation formula:

Follower trading lot = copy trading volume

Copy volume:The volume of trades opened per copy

Copy Direction:Direction modifier for copying trades.

-

- Positive: The signal source is short, and the follower is short. Signal Source Long, Follower Long

- Reverse: signal source long, follower short, signal source short, follower long

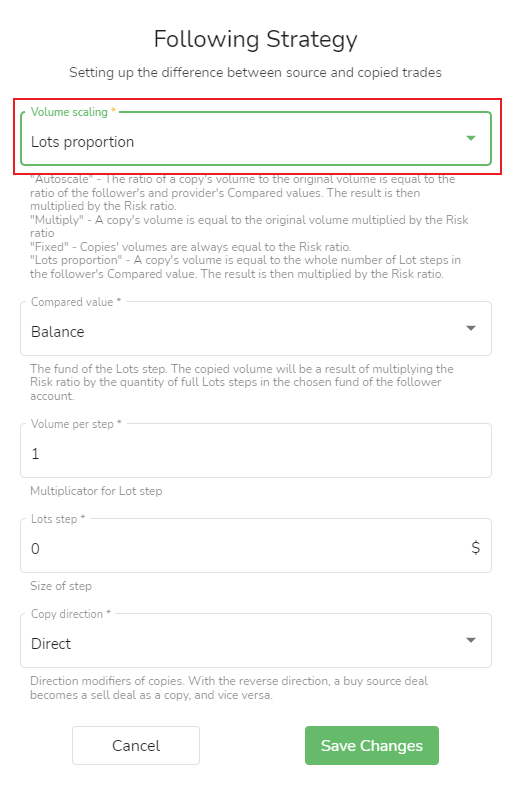

b1.4. Proportion of trading lots

The volume of the copy trade depends on the current balance or equity of the follower's account. Followers can adjust the copy trading volume according to the current account balance or net value to control the risk of copying

Calculation formula:

The due position of the documentary account = the integer value of the step of the balance (or equity) of the documentary account, and then multiplied by the transaction volume of each step

Comparison value:The ratio of the signal source and the trading volume of the follower's account, you can choose [Balance] or [Equity]

Transaction volume per step:Lot step size multiplier.

Lot step size:Step size, which is to set the amount size of the transaction volume per step.

Copy Direction:Direction modifier for copying trades.

-

- Positive: The signal source is short, and the follower is short. Signal Source Long, Follower Long

- Reverse: signal source long, follower short, signal source short, follower long

b2. Example of Volume Expansion Calculation

multiplier example

Volume Multiplier: 3

Follower balance: $1,000

Signal Source Balance: $10,000

Signal source: Buy 1 lot of EURUSD

Follower: Buy 3 lots of EURUSD

calculation process:

Follower trading volume = signal source trading volume * trading volume multiplier

3 lots traded = 1 lot traded * 3

Autoscale example

Compare Value: Balance

Ratio Multiplier: 5

Follower balance: $1,0410

Signal source balance: $20140

Signal source: Buy 1 lot of EURUSD

Follower: Buy 2.58 lots of EURUSD

calculation process:

Follower's trading volume = follower's balance \ signal source's balance * signal source's position * proportional multiplier

2.58=10410\20140*1*5

fixed example

Copy volume: 2 lots

Signal source: Buy 1 lot of EURUSD

Follower: Buy 2 lots of EURUSD

calculation process:

Follower's trading volume = set fixed trading volume

Example of Lot Ratio

Compare Value: Balance

Volume per step: 1

Lot step size: 1000

Follower balance: $10000

Signal source: Buy 1 lot of EURUSD

Follower: Buy 10 lots of EURUSD

calculation process:

Copy trading volume lot = trading volume per step * (follower comparison value / lot step)

10 = 1*(10000\1000)

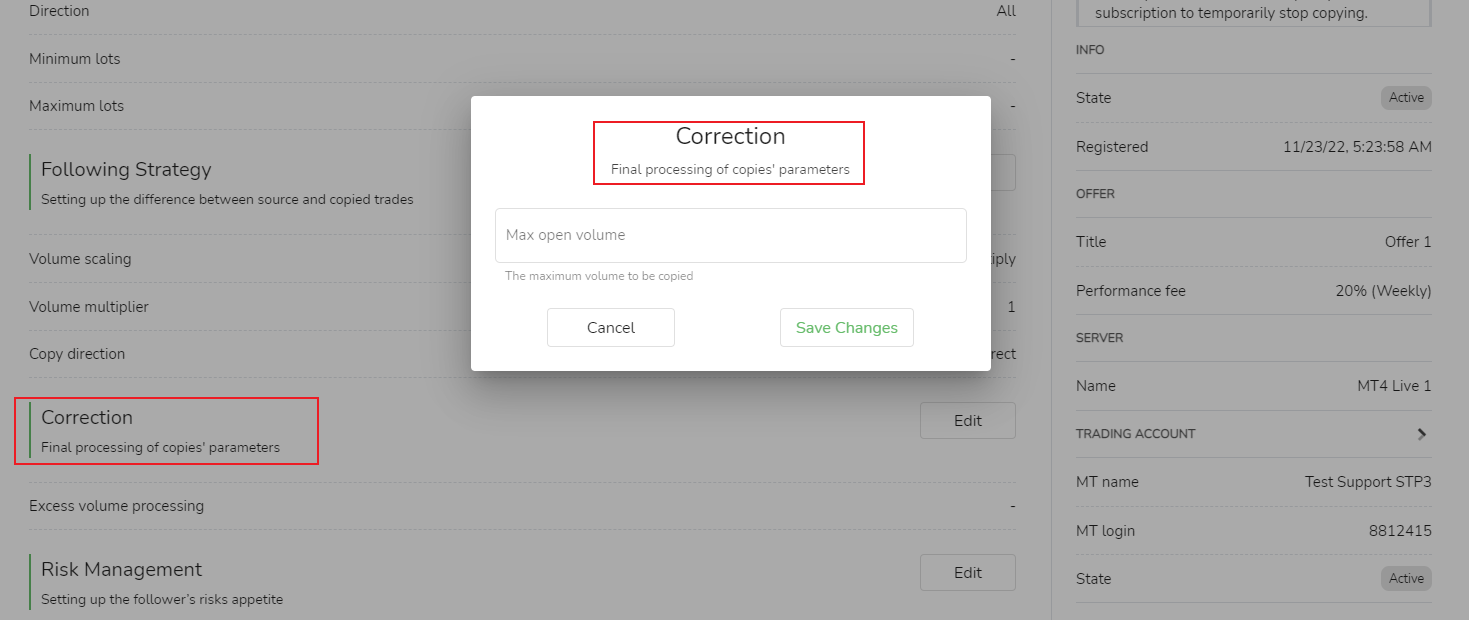

c. Correction

-

- The correction sets the maximum amount of copied trades that will eventually be executed. CopyTrading's follower can not only control the risk of the trading position of the signal source, but also control the risk of the size of the position they should place.

- Maximum transaction volume that will follow:

【jump over】: If the position to be placed in the follow-up account exceeds the maximum trading volume set, the follow-up will not be performed

[Zoom out]:If the position to be placed in the follow-up account exceeds the maximum trading volume set, it will be followed according to the maximum trading volume set

c1. Example of correction calculation

Example 1:

Volume Scaling: Autoscaling

Compare Value: Balance

Ratio Multiplier: 5

Maximum transaction volume: 2 lots

Execution: zoom out

Follower balance: $10410

Signal source balance: $20140

Signal source: Buy 1 lot of EURUSD

Follower: Buy 2 lots of EURUSD. Originally, according to the automatic scaling rule, the follower should buy 2.58 lots, but because the maximum trading volume is set, he finally bought 2 lots.

Example 2:

Volume Scaling: Autoscaling

Compare Value: Balance

Ratio Multiplier: 5

Maximum transaction volume: 2 lots

Execution: skip

Follower balance: $10410

Signal source balance: $20140

Signal source: Buy 1 lot of EURUSD

Follower: short position, skip copying. Originally, according to the automatic scaling rule, the follower should buy 2.58 lots, but this value is higher than the maximum trading volume of 2 lots, so it is skipped, and the follower does not follow the order.

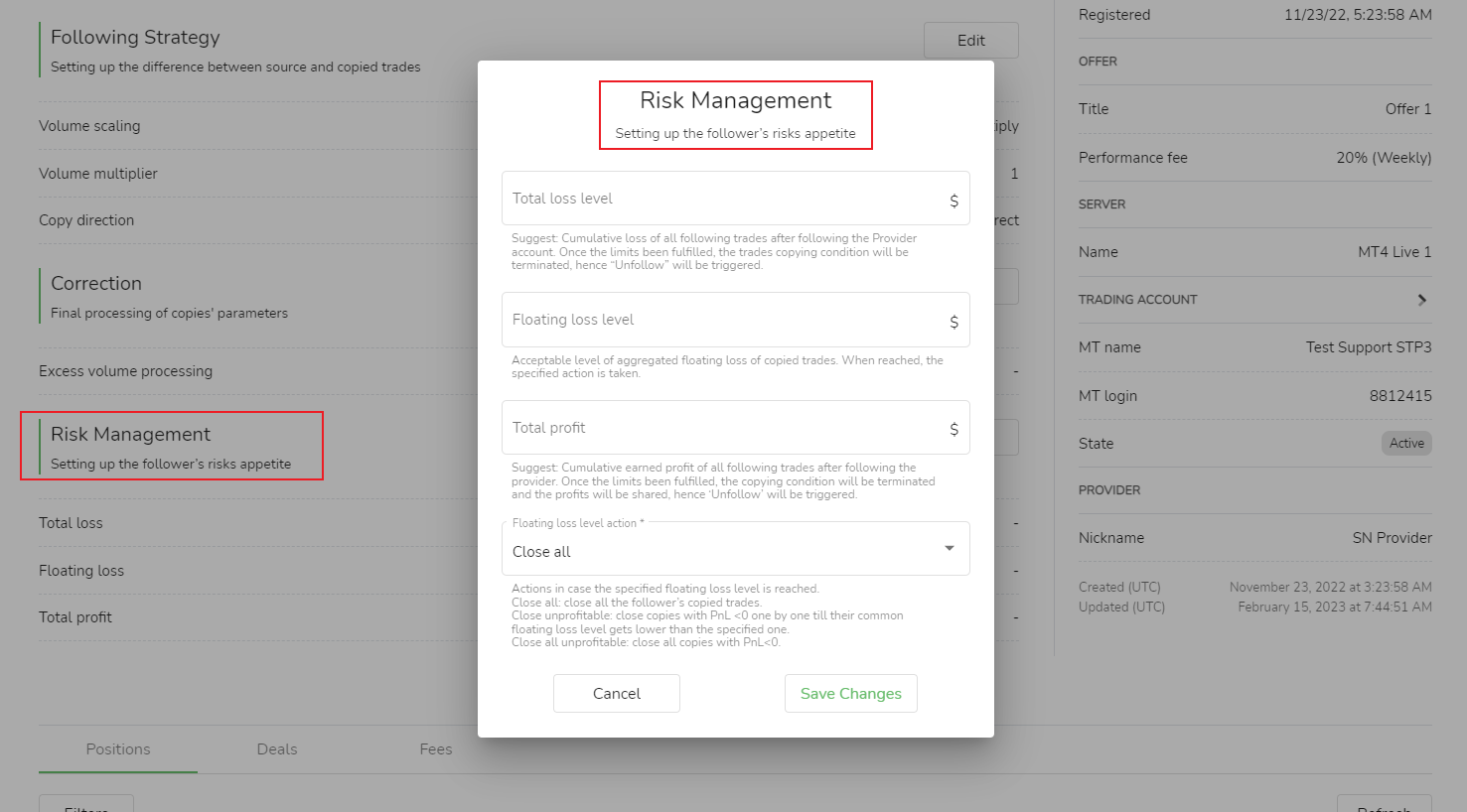

d. Risk management

Followers can set take-profit and stop-loss levels in risk management to manage the risk of their own accounts.

d1. Total loss level

Cumulative loss of all following trades since joining the signal source account. Once reached, the copying condition will be terminated, and there will no longer be a following relationship between the follower and the signal source.

d2. Floating loss level

The total floating loss level acceptable for copy trading. When it is reached, you can choose [Close All], [Close Unprofitable Positions] and [Close All Unprofitable Positions]. Please refer to the following [3.6.d4. Floating Loss Level Operation] for specific option analysis.

d3. Total profit

Cumulative realized profit of all following trades since joining the signal source. Once met, the copying condition will be terminated and the profits will be shared.

d4. Floating loss level operation

The operations performed when the specified floating loss level is reached include the following:

- 【Close all】:Close copy trading for all follow accounts

- [Close unprofitable positions]:According to the order of loss from high to low, close unprofitable copy transactions one by one until the floating loss level is lower than the set specified level

- 【Close all unprofitable positions】:Close all copy trades whose profit is below the specified level set

d5. Examples of risk management operations

Example 1:

The total loss level is set at: $1,000

The floating loss level is set at: $500

Floating loss level operation: closing unprofitable positions

Order 1: Floating P&L: -$300

Order 2: Floating P&L: -$200

Order 3: Floating P&L: -$100

Since the floating loss level of the three copies has reached USD 600 (the loss exceeds USD 500 for more than 120 seconds), and the floating loss level exceeds the USD 500 setting, the floating loss level operation is set to: close the unprofitable position, so the position will be closed first Copy order 1, keep copy order 2 and 3 (at this time, the floating loss is 300, which is lower than the set 500).

Example 2:

The total loss level is set at: $1,000

The floating loss level is set at: $500

Floating loss level operation: close all unprofitable positions

Order 1: Floating P&L: -$300

Order 2: Floating P&L: -$200

Order 3: Floating P&L: -$100

Since the floating loss level of the three orders has reached $600 (the loss exceeds $500 for more than 120 seconds), the floating loss level set by exceeding $500, and the floating loss level operation is set to: close all unprofitable positions, so copy 1 , 2, and 3 will all be closed, but the follower still retains the following relationship with the signal source.

Example 3:

The total loss level is set at: $1,100

The floating loss level is set to: $1000

Floating loss level operation: close all unprofitable positions

Order 1: Floating P&L: -$500

Order 2: Floating P&L: -$400

Order 3: Floating P&L: -$300

Since the floating loss level of the three copies has reached USD 1,200, exceeding the total floating loss level set by USD 1,000, the floating loss level operation setting is: close all unprofitable positions, so the copying orders 1, 2, and 3 will all be equalized The position is closed, because the actual total loss after closing the position is: 1200 US dollars, which exceeds the amount set by the total loss level: 1100 US dollars, at this time the follower archives and releases the following relationship with the signal source.

Example 4:

The total loss level is set at: $1,000

Total Profit is set to: $500

Floating loss level operation: close all

Order 1: Floating P&L: -$100

Order 2: Floating P&L: +$300

Order 3: Floating P&L: +$400

Since the total profit level of the three copy orders has reached 600 US dollars, exceeding the total profit set by 500 US dollars, and the floating loss level operation is set to close all, so copy orders 1, 2, and 3 will all be closed and closed, and the follower The final profit is $600, but the following relationship between the follower and the signal source still exists.